인증 된 전문가를 찾으십시오

인증 된 전문가를 찾으십시오

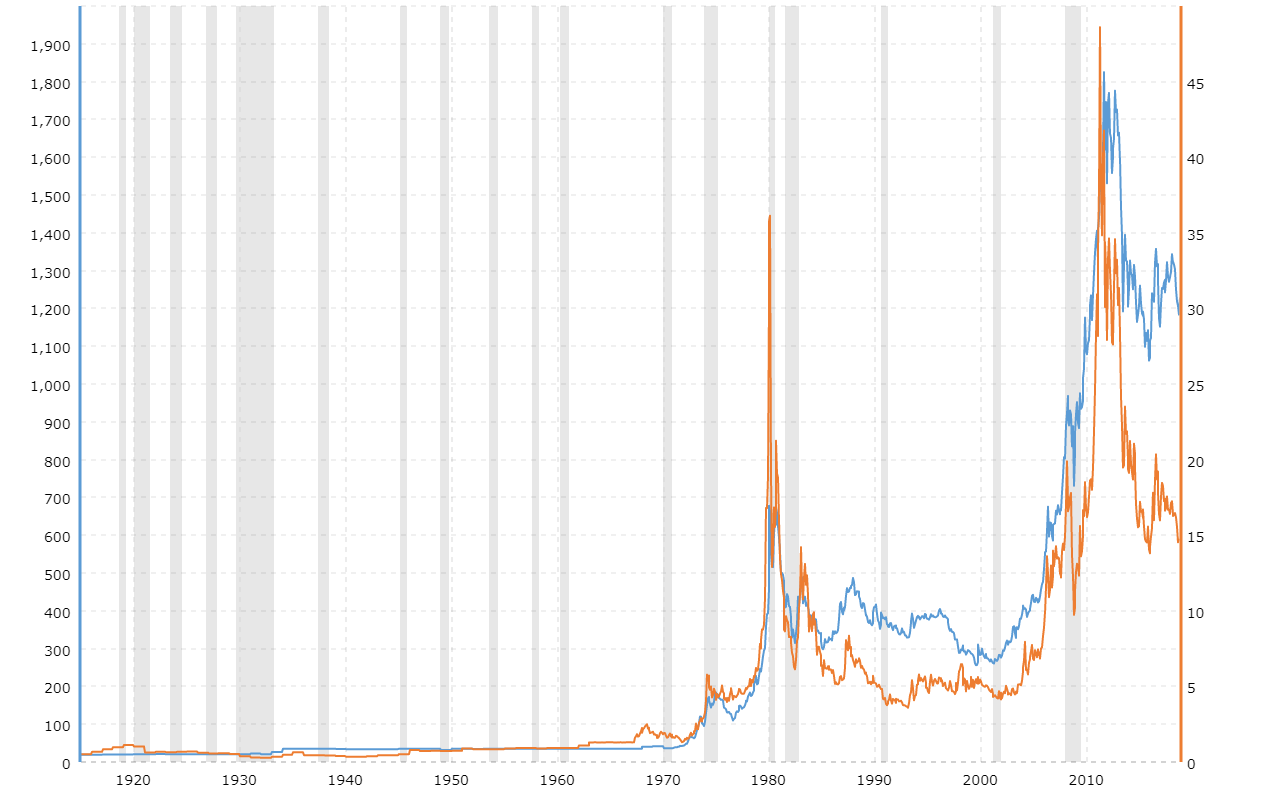

The only holding of the fund is gold bullion. The value and volume of the SPDR Gold Trust make it extra favorable for day trading. 1. Those who make issues occur. And whereas GLD is not any substitute for physical gold in your personal arms, GLD could also be an choice for any mates or relations who cannot be swayed to purchase bodily. Most of the gold is saved as normal bars weighing four hundred troy ounces (12.Four kg or 438.9 ounces) - there are about 500,000 of them, each worth in the area of £350,000. Once the pause has occurred, purchase when the worth breaks above the pause’s excessive, as we're going to assume that the value will continue to trend larger. Deal with gold ETFs and trusts when the day-to-day price gold is fluctuating at least 2%. Apply a 14-day average true vary (ATR) indicator to a gold every day chart, then divide the current ATR value by the ETF’s or trust’s present worth, and multiply the outcome by 100. If the number isn’t above 2, then the market shouldn't be ideal for day-buying and selling gold ETFs or trusts. Throughout the uptrend at the proper within the determine above, the day-to-day movement is often less than 2% (ATR reading divided by price), which is widespread in a trending setting.

The only holding of the fund is gold bullion. The value and volume of the SPDR Gold Trust make it extra favorable for day trading. 1. Those who make issues occur. And whereas GLD is not any substitute for physical gold in your personal arms, GLD could also be an choice for any mates or relations who cannot be swayed to purchase bodily. Most of the gold is saved as normal bars weighing four hundred troy ounces (12.Four kg or 438.9 ounces) - there are about 500,000 of them, each worth in the area of £350,000. Once the pause has occurred, purchase when the worth breaks above the pause’s excessive, as we're going to assume that the value will continue to trend larger. Deal with gold ETFs and trusts when the day-to-day price gold is fluctuating at least 2%. Apply a 14-day average true vary (ATR) indicator to a gold every day chart, then divide the current ATR value by the ETF’s or trust’s present worth, and multiply the outcome by 100. If the number isn’t above 2, then the market shouldn't be ideal for day-buying and selling gold ETFs or trusts. Throughout the uptrend at the proper within the determine above, the day-to-day movement is often less than 2% (ATR reading divided by price), which is widespread in a trending setting.

![]() These are the really useful circumstances for day trading, though the gold trusts and ETFs could be traded utilizing the following methodology even during nonvolatile (lower than 2% every day movement) instances. The iShares Gold Trust is about one-fifth the worth of the SPDR Gold Trust, and it will therefore have smaller intraday motion in absolute greenback phrases, however the lower worth signifies that larger portions could be traded. If forecasts predict rising gold prices, securing a loan early can maximize the mortgage amount because of larger collateral worth. When the value of gold is steady, the gold miners might provide barely more day-trading opportunities due to their higher volatility. ETFs can provide a extra liquid and easier strategy to investing in valuable metals than buying futures contracts, buying bullion, or shopping for inventory in publicly traded companies involved within the exploration or manufacturing of those metals. The Gold Miners and Junior usd gold price Miners ETFs are sometimes extra volatile than the gold trusts. The valuable metals exchange-traded funds (ETFs) with the perfect one-year trailing whole returns are IAUM, GLDM, and SGOL.

These are the really useful circumstances for day trading, though the gold trusts and ETFs could be traded utilizing the following methodology even during nonvolatile (lower than 2% every day movement) instances. The iShares Gold Trust is about one-fifth the worth of the SPDR Gold Trust, and it will therefore have smaller intraday motion in absolute greenback phrases, however the lower worth signifies that larger portions could be traded. If forecasts predict rising gold prices, securing a loan early can maximize the mortgage amount because of larger collateral worth. When the value of gold is steady, the gold miners might provide barely more day-trading opportunities due to their higher volatility. ETFs can provide a extra liquid and easier strategy to investing in valuable metals than buying futures contracts, buying bullion, or shopping for inventory in publicly traded companies involved within the exploration or manufacturing of those metals. The Gold Miners and Junior usd gold price Miners ETFs are sometimes extra volatile than the gold trusts. The valuable metals exchange-traded funds (ETFs) with the perfect one-year trailing whole returns are IAUM, GLDM, and SGOL.

ETFs and trusts are each acceptable for day-buying and selling functions. There are 15 valuable metals ETFs that trade within the U.S., excluding inverse and leveraged ETFs in addition to funds with less than $50 million in belongings below administration (AUM). There are gold ETFs with a number of liquidity, and unlike futures, the ETFs don’t expire. Precious metals reminiscent of gold, silver, and platinum are valued by many traders as a hedge against inflation or a secure haven in instances of economic turmoil. Before investing in gold, it helps to take be aware of some of the important thing elements that make it a horny funding. Remember, day trading depends on short-time period volatility to make for a worthwhile method to trading. Blockchain might have extensive-ranging software from the financial industry to vitality trading platforms, and its makes use of might stretch from business-to-business transactions all the way in which right down to peer-to-peer. Most international locations have one design that continues to be constant annually; others (such because the Chinese Panda coins) have variations every year, and in most cases each coin is dated. Deciding whether or not to buy gold coins or gold rounds depends largely in your funding targets and preferences. The primary issue to consider when figuring out the worth of American Gold Eagle coins is their gold content and purity.

GLDM goals to mirror the performance of the price of gold minus fund expenses. SGOL is structured as a grantor trust that seeks to track the performance of the value of gold bullion minus fund bills. The ETF is structured as a grantor belief, which can provide investors with a sure diploma of tax protection. Since IAUM is regarded as a collectible, buyers ought to know that any long-term gains could have important tax liabilities. Be aware that you just might should pay import tax. The worth will need to have not too long ago made a swing excessive for an uptrend, and you are looking to enter on a pullback. There are liquidity dangers and margins you need to take care of; if you can not cowl reductions in values, your supplier could close your position, and you may have to meet the loss it doesn't matter what subsequently happens to the underlying asset. Geopolitical events world wide can have a significant impression on commodity prices, including silver. GLDM has a decrease expense ratio than many different various treasured metallic commodity ETFs.

등록된 댓글이 없습니다.